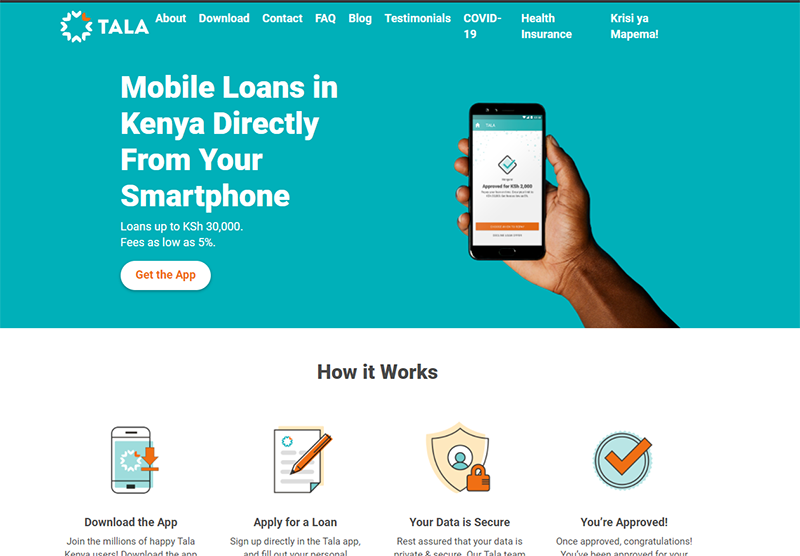

Mkopo Rahisi, is a mobile-based loan service owned by InVenture Mobile Limited (Tala).

Using an app they instantly scores individuals and offers Mpesa loans to those who lack access to formal financial services.

One does not need to have a bank account to access a loan, but he or she must own a mobile phone with mobile money platform MPesa and a connection to social media sites, such as Facebook.

Mkopo Rahisi profiles prospective customers using their financial transactions, as well as the data on their social media accounts and web searches. From this, it works out the terms of loans and delivers the money instantly through Mpesa to their mobile phones.

Mkopo Rahisi pays a maximum of Sh10,000 at interest rates of between 5 and 15 per cent.

Founded in 2012, InVenture is based in New York and has offices in Santa Monica, New York and Nairobi. The app’s main competitor is M-Shwari, which is a partnership between Commercial Bank of Africa (CBA) and Safaricom.

Mkopo Rahisi loan app was launched in Kenya in March 2014, and has since expanded to Tanzania, with its eye on more African markets.

The app, available through Android’s Google store, was as a result of more than 3, 000 interviews of individual borrowers across countries in Africa over two-and-a-half years.

Currently, it has been downloaded over a million times. By end of 2015 it had more than 50,000 active customers and disbursed 120,000 loans to middle and low-income Kenyans.

“From the start of the loan application to the receipt of money can take as little as two minutes. Of our users, 88 per cent are done with the loan application in under 10 minutes,” said Mkopo Rahisi Kenya Business Director Ronald Maira.

He added that the idea of short-term loans requiring no collateral has been a key selling point for them, which has seen the app register a client return rate of 92 per cent.

The credit company depends on social media platforms and testimonials from previous beneficiaries to grow its customer base. Some of the key components that Mkopo’s risk analysis encompasses are M-Pesa transaction history, social network activity, education, employment, browsing history, spending patterns and previous loan history.

The company plans to increase its credit limit to Sh100,000 in the future, especially for customers with a strong repayment history. Of the loans disbursed so far, 55 per cent have been for purposes of business, and 19 per cent for travel expenses.

A further 14 per cent have been taken by customers who wanted to attend to emergencies. Among those who took out loans for business, 42 per cent used the money to boost their stock, while 23 per cent used it to start a business. Vincent Mbogori runs an electronics shop in Nairobi, and said he has so far taken 43 loans at an average Sh6,000 each time to boost his business. “I have established a good relationship with Mkopo Rahisi since last year, and now I borrow up to Sh7,000, sometimes at an interest rate of 10 per cent,” he said, adding that he hopes to see the credit limit increased to at least Sh20,000. The app determines interest rates based on a customer’s credit score.

Top on the list of worries of any financial lender is borrowers who default on their loans, a concern Mkopo Rahisi shares. The app relies on information from InVenture — which currently operates in Eastern Africa, South Africa and India — that is collected from an applicant’s mobile phone for a real-time credit score. With this, defaults have remained below 12 per cent, Mr Maira said.

“With the user’s permission, InVenture collects data from the applicant’s mobile device to verify identity, build financial, behavioural, and social characteristics for our proprietary algorithm, and to customise the loan terms to his or her unique circumstances,” he added.

Financial muscle: The capital required to get Mkopo Rahisi off the ground was injected by InVenture and other institutional capital providers. Since then, the app has built its financial muscle through Google Ventures, Lowercase Capital, Data Collective and Collaborative Fund.

Having tested the Tanzanian market, Mkopo hopes to get into more African markets in the next three to six months, and plans to hire a regional director to oversee East African markets. It will also soon migrate from a web app to a native app to increase its service speed and optimise it for low-speed data connections in Kenya. “We hope that through this, we will be able to provide all Kenyans with fair and flexible financial products,” said Maira.