Reasons for business failure in Kenya are numerous but there are some that have more weight on why small business fail in the first year especially.

How is your business currently doing? Do you feel like your business is growing? Are you making profits? Today more than ever, we are experiencing one of the highest level of business failure in Kenya. Business failure doesn’t just happen overnight, generally there are early signs that are usually ignored. When running your own business, it’s crucial to pay attention for the red flags highlighted here.

Why small business fail is always going to be more or less the same, keep a close eye on your business to enable you identify the causes of business failure. Things to watch out for are:

1. Problems paying regular PAYE, TAX or VAT bills is one of the early warning signs why small business fail. This can worsen very fast into an uncontrollable level of debt. If you are failing to file for taxes for your business or have Tax issues, speak to the good guys at the Kenya Revenue Authority, and find out if they can offer you any payment arrangements that can help you pay.

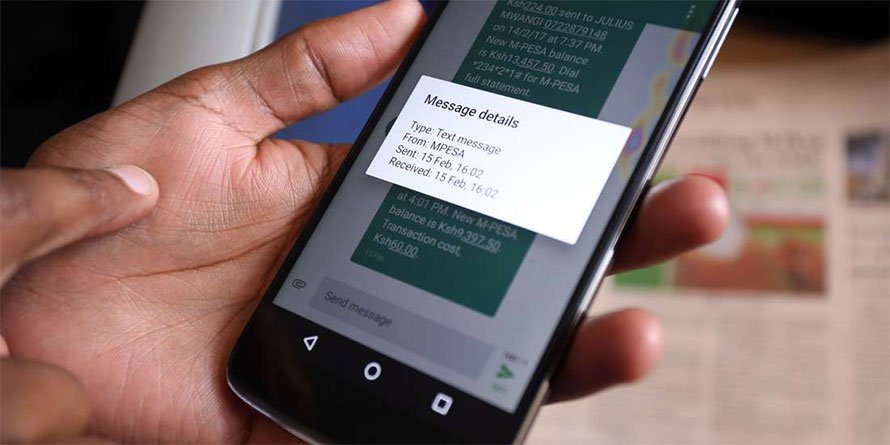

2. Regular cash flow problems. Kenya’s unique business ethic is quite energetic. It’s because of this that you will hear many Kenyan business owners saying how much they have owed to them. Plenty or profits in the pipeline, but then again why small business fail is because they lack the working capital to keep the business operating until the payments are made.

They say in Kenya there is a lot of work but no one wants to pay for it, at least not immediately after you finish the work. The customer would rather pay part payment with a promise to pay the rest later not realizing its actually killing our small businesses.

When you are running a business in Kenya, make sure you have enough working capital to avoid cash flow disasters. Avoid collecting client debt too late or paying creditors too early to allow you make the most out of your working capital which will then help you grow your business.

3. Being busy, but not making extra money.

There is plenty of work in Kenya as long as you are ready to work for free or better still wait for the payment when it “rains”. You would rather walk on water if your business is too busy grinding but not making any money. This is a bad sign, part of the reasons for business failure that cannot be ignored. Find out what is going wrong before you can correct this. Ask yourself, are you spending more time dealing with customer problems as they show up rather than planning strategically to avoid them?

Take time to look at your business as a whole to find out what the main problem is. Once you have identified the problem then this is the opportune moment to fix it. Feeling there is a problem and not doing anything about it, is the same as burying your head in the sand and expecting your problems to go away.

Make a clear strategy with goals in place that will guide you monitor the progress in bettering your business going forward.

4. Customer complaints as part of the reasons for business failure

The increase in number of customer complaints and returns could mean that you are spending too much time chasing new business and forgetting existing customers. This is one of the business failure indicators that can’t be ignored adding on our list of top reasons for business failure in Kenya. We have business with a lot of customer complaints yet the business owners or staff never take these signs seriously until the day they are forced to close up shop.

New business is essential, but existing customers and clients are possibly even more important. Make sure you look after existing customers, as well as working on acquiring new ones.

5. Not investing in your business is why small business fail in Kenya.

Since finances are mostly tight for small businesses in Kenya, most fail to invest and instead choose to save which can sometimes be fatal. With time, failure to invest in new gear, for example, can lead to higher maintenance bills for your old stuff and result in reduced efficiency and loss of market share.

6. Constantly looking for business loans

If you’re constantly looking for a higher overdraft limit or larger business loan, or considering borrowing from friends to help run your business, you should immediately take a step back and ask yourself why?

Putting more money in your business is hardly the solution for business failure in Kenya. It’s could be something important that needs changing, so think about what it is.

As you work on your business, stay focused and remember when you identify one of the reasons for business failure do not panic. It doesn’t automatically mean your business is destined to fail the red flags mean you should take urgent action to save your business from failure. The sooner you solve the problems of why small business fail in Kenya, the more chance you will have of growing your business, serving Kenyans and changing lives for the better.