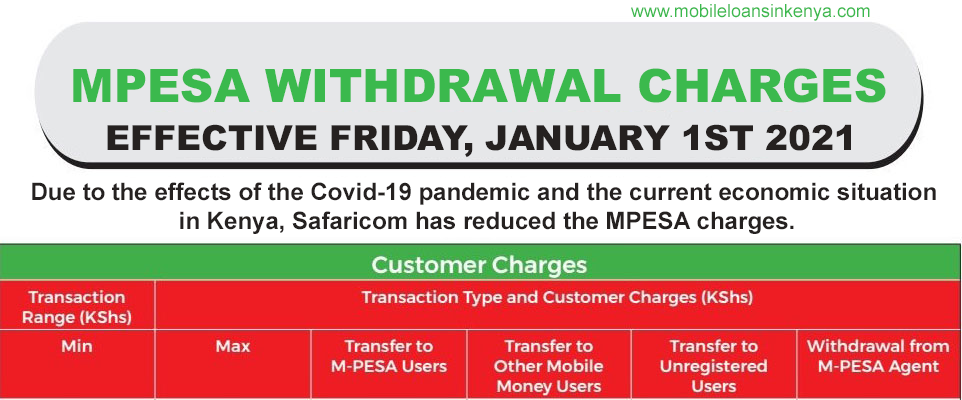

MPESA withdrawal charges with new updated list as of 1st January 2021. Due to the effects of the Covid-19 pandemic and the current economic situation in Kenya, Safaricom has reduced the MPESA charges especially for customers sending cash.

As part of different measures to help the country better weather the Covid-19 Pandemic, we announced the temporary zero-rating of MPESA transactions. Our regulator, the Central Bank of Kenya under the leadership of Dr. Patrick Njoroge has been instrumental in the formulation of this and other measures across the financial sector which have resulted in significant gains in the form of the ongoing economic recovery, the Chief Executive Officer Peter Ndegwa said.

MPESA Withdrawal charges from MPESA Agent

Below are the MPESA Withdrawal charges you should expect to pay when withdrawing cash through the Safaricom MPESA service in Kenya. These charges change from time to time, and we always make an effort to ensure these rates are always the latest updates from Safaricom.

If you find any errors on these numbers, inform us by posting your comments on the bottom of this page. Thank you.

| Min(KSHs.) | Max(KSHs.) | MPESA Withdrawal Charges |

| 1 | 49 | N/A |

| 50 | 100 | 10 |

| 101 | 500 | 27 |

| 501 | 1,000 | 28 |

| 1,001 | 1,500 | 28 |

| 1,501 | 2,500 | 28 |

| 2,501 | 3,500 | 50 |

| 3,501 | 5,000 | 67 |

| 5,001 | 7,500 | 84 |

| 7,501 | 10,000 | 112 |

| 10,001 | 15,000 | 162 |

| 15,001 | 20,000 | 180 |

| 20,001 | 35,000 | 191 |

| 35,001 | 50,000 | 270 |

| 50,001 | 150,000 | 300 |

Fuliza Mpesa loan, rates, limit, app and how it works Now Dial *234# Safaricom

MPESA Transfer to Unregistered Users

When you send money using MPESA to a number that is not registered to the Safaricom MPESA service, you will be charged a bit higher than sending money to a number that is registered to MPESA.

Below are the charges for MPESA transfer to unregistered users.

| Min(KSHs.) | Max(KSHs.) | MPESA Charges |

| 1 | 49 | N/A |

| 50 | 100 | N/A |

| 101 | 500 | 45 |

| 501 | 1,000 | 49 |

| 1,001 | 1,500 | 59 |

| 1,501 | 2,500 | 74 |

| 2,501 | 3,500 | 112 |

| 3,501 | 5,000 | 135 |

| 5,001 | 7,500 | 166 |

| 7,501 | 10,000 | 205 |

| 10,001 | 15,000 | 265 |

| 15,001 | 20,000 | 288 |

| 20,001 | 35,000 | 309 |

| 35,001 | 50,000 | N/A |

| 50,001 | 150,000 | N/A |

Transfer to other MPESA Users

Find the MPESA rates for sending money through MPESA to other MPESA users.

| Min(KSHs.) | Max(KSHs.) | MPESA Charges |

| 1 | 49 | FREE |

| 50 | 100 | FREE |

| 101 | 500 | FREE |

| 501 | 1,000 | FREE |

| 1,001 | 1,500 | 26 |

| 1,501 | 2,500 | 41 |

| 2,501 | 3,500 | 56 |

| 3,501 | 5,000 | 61 |

| 5,001 | 7,500 | 77 |

| 7,501 | 10,000 | 87 |

| 10,001 | 15,000 | 97 |

| 15,001 | 20,000 | 102 |

| 20,001 | 35,000 | 105 |

| 35,001 | 50,000 | 105 |

| 50,001 | 150,000 | 105 |

Most times when we are grinding on with life we may encounter times when we accidentally send money through MPESA to the wrong number. With the Covid-19 pandemic and the current tough financial struggles, some Kenyans have enhanced their MPESA withdrawing skills to new levels, especially for MPESA transactions that have been sent to them in error.

One life saver number that will certainly come in handy in such unfortunate situations is the 456. This reversal number will enable you to quickly reverse MPESA sent to wrong number back to your MPESA account. Immediately you realise the mistake made, send the MPESA message that you just received of the wrong MPESA transaction confirmation to 456.

Reverse MPESA sent to wrong number by sending the MPESA confirmation message to 456

Hopefully if this reversal request is done in good time, Safaricom may just be able to put a hold the wrong MPESA cash sent and reverse the cash back to your account.

Transfer to other Mobile Money Users

The MPESA service now allows you to send money to other mobile money numbers. The cost of this service is also a bit high as compared to sending the MPESA to MPESA registered users.

Below are the charges for sending money using MPESA to other mobile money users like the Airtel Money.

| Min(KSHs.) | Max(KSHs.) | MPESA Charges |

| 1 | 49 | N/A |

| 50 | 100 | N/A |

| 101 | 500 | 11 |

| 501 | 1,000 | 15 |

| 1,001 | 1,500 | 26 |

| 1,501 | 2,500 | 41 |

| 2,501 | 3,500 | 56 |

| 3,501 | 5,000 | 61 |

| 5,001 | 7,500 | 77 |

| 7,501 | 10,000 | 87 |

| 10,001 | 15,000 | 97 |

| 15,001 | 20,000 | 102 |

| 20,001 | 35,000 | 105 |

| 35,001 | 50,000 | 105 |

| 50,001 | 150,000 | 105 |

MPESA ATM Withdrawal

Now its also possible to withdraw cash through MPESA using bank ATM machines countrywide. For this service, the MPESA ATM Withdrawal charges as shown below for your convenience.

| Min(KSHs.) | Max(KSHs.) | MPESA ATM Withdrawal Charges |

| 200 | 2,500 | 34 |

| 2,501 | 5,000 | 67 |

| 5,001 | 10,000 | 112 |

| 10,001 | 20,000 | 197 |

Other Transactions

Most of the other MPESA services are usually FREE as shown below.

| Other Transactions | Kshs. |

| All Desposits | FREE |

| MPESA Registration | FREE |

| Buying Airtime through MPESA | FREE |

| MPESA balance Enquiry | FREE |

| Change MPESA PIN | FREE |

MPESA withdrawal charges will depend on the amount you are sending or withdrawing. You can use your MPESA menu to buy airtime for your phone, or for someone else. This service is free and you will only pay for the airtime purchased.

Important:

- MPESA withdrawal charges are updated frequently, always check before you withdraw.

- You can now have up to a maximum balance of KSHs.300,000 in your MPESA account.

- Per day you can transact up to a maximum of KSHs.300,00o, but a maximum of KSHs. 150,000 per transaction.

- The minimum you can withdraw from your MPESA Agent is KSHs.50.

- To reverse MPESA sent to wrong number, you need to immediately send the MPESA transaction confirmation message to 456.

- To be able to do MPESA transaction, your Safaricom line and MPESA account must be active.

- You cannot deposit money directly into another MPESA customer’s account through an MPESA agent.

- Each MPESA transaction you complete earns you Bonga points that you can use as a means of payment for other Safaricom products are services.

- The original identification document, i.e., National ID or Kenyan Passport that you used when registering for MPESA services, will be required as a form of identification for al transactions done at the MPESA Agent outlet.

The above Safaricom MPESA withdrawal charges have been referenced from the Safaricom official website.

Check Fuliza Loans, Safaricom’s loan app and see what you need to apply.

Kindly, leave your comment below at the bottom of this page if you find any errors on these MPESA withdrawal charges.

]]>Fadhili loan app

You can now get up to Ksh 300,000 fast and convenient to your Mpesa when you dial *483*013# using a regular mobile phone or though their app when you download the app.

When applying for the Fadhili mobile loan, your creditworthiness is how Fadhili determines if you will default on your loan agreement, or how worthy you are to receive the requested loan amount by the answers you give.

You should ensure you answer the Fadhili loan application truthfully and correctly. Even if you are not employed, this doesn’t not stop you from accessing the loan. Giving false information may and it’s also illegal.

Your loan application is determined by a collection of information collected from you when applying. How you repay or have paid your past loans, your Mpesa usage details (it helps to also have 10,000 data points), your current income and social media activity are some of the information that affect your Fadhili loan application being rejected or approved.

You can get the Fadhili loan app by downloading using the link below.

How to pay your Fadhili mobile Loan

When your loan repayment is due, it is best to pay using the MPesa Fadhili pay bill number 995321.

- To pay, using your mobile phone go to the Safaricom menu.

- Then choose MPesa.

- Now choose the Lipa na MPesa menu.

- Choose the Pay Bill option.

- On the business number enter the Fadhili Loan paybill number 995321.

- Under account number enter your Fadhili registered phone number as the account number.

- Enter the amount you would like to pay.

- Complete your loan repayment by the Enter your MPesa PIN.

Fadhili Loan Fees and commissions:

Fadhili offers unsecured loans for amounts between Ksh 250 to Ksh 70,000.

For loan amounts from Ksh 70,000 to Ksh 10 Million you can only apply for it as secured loan.

Both unsecured and secured Fadhili loans have repayment periods between 4 months to 5 years.

The annual percentage rate (APR) which is the annual rate of interest charged to you as the borrower and paid to Fadhili as the lender over the loan you take is between 25% to 240%.

Additionally, there is also an Annual Ledger Fee/Account Maintenance Fee of between Ksh 100 to Ksh 400 depending on the loan amount borrowed.

Unsecured Fadhili mobile loan from ksh 250 to ksh 70,000 can be applied through their app or by dialling 483013#.

Usually there is a flat fee on the loan amount borrowed, say you borrow ksh 10,000, you will be charged a flat fee of ksh 2,500, with no late fees or rollover charges.

For secured loans of between ksh 70,000 to 10 Million, you should apply online then visit Fadhili offices to avail the requested documents to support your application.

If you pay your loan late, even up to a year late, you will not suffer additional charges for the late repayment. But it is important to remember, late loan repayments by over 180 days may lead to your name being listed with the Credit Reference Bureau (CRB) in Kenya which may affect your credit rating and future capacity to borrow from any other lender including banks.

It’s important to read 5 Questions to ask yourself before you take a Loan.

What happens when you cannot pay your Fadhili mobile loan on the agreed time.

If for any reason you cannot make the repayment within the period specified in the initial loan contract, the loan will be rolled over for at least two weeks and an extension fee added to your loan, with no interest charged on the extension.

Fadhili will decide how much extension fee and extra time they will offer you for any late repayment.

Fadhili Loan Contacts:

To get Fadhili loan contacts use the details provided below.

Fadhili mobile contacts: 0 720 686 009 (Kenya if you are calling outside Kenya remember to add +254 and remove the first zero)

For email inquiries: [email protected]

Fadhili loan website: http://www.fadhilimobile.co.ke/

Fadhili Facebook page: https://web.facebook.com/Fadhili-878251965709717/

If you have borrowed using the Fadhili loan app, please leave a comment below, and share your experience with us.

MShwari

MShwari is a paperless banking service offered through MPESA.

- Enable you open and operate an MShwari bank account through your mobile phone, via MPESA, without having to visit banks or fill out any forms.

- Provide you the ability to move money in and out of your MShwari savings account to your MPESA account at no charge.

- Give you an opportunity to save as little as KSh 1 and earn interest on your saving balance. This cash is moved into the savings account via M-PESA.

- Enable you to access an Mshwari loan of a minimum of KSh 100 any time and receive your loan instantly on your MPESA account.

This is a product for everyone who feels that banking should be hassle-free. No forms to fill in, no branches to visit. Just one click on your phone and you have a savings account!

Now you can get going, Lainisha maisha na MShwari.

Before taking a loan it is wise to read our 5 Questions to ask yourself before you take a Loan.

See: How to apply Fuliza Mpesa Loan

Check out the other Top 10 Loan Apps in Kenya, KCB Mpesa Loan, Saida Loan, MShwari, Timiza Loan, okolea Loan, Okash Loan, Tala Loan.

KCB MPESA LOAN

KCB MPESA Loan account is a mobile based account offered exclusively to MPESA customers enabling you to:

- Access Mpesa loans at attractive low interest rates of 1.16% per month with a one off negotiation fee of 2.5%. The cost for the one month loan is 3.66% with excise duty applicable on fees.

- Save for a fixed period of time (Fixed Deposit Account) or save a little at a time for a set period (Target Savings Account) and earn interest of up to 7% p.a.

- Transfer money in and out of the KCB MPESA LOAN Account for FREE.

- You can apply for the KCB Loan by accessing your Safaricom MPESA menu on your phone.

- Once on the menu select Loans and Savings

- There after select KCB MPESA and Activate.

KCB MPESA LOANS FEATURES

- Upon activating the account, you will be issued with a loan limit from where you can borrow instantly. MPESA Loans issued are deposited into the KCB MPESA LOAN Account.

- You can access loan limits from as low as Ksh. 50 up to Ksh. 1M.

- Enjoy loan repayment periods of 30 days.

- Loan repayment can be made through MPESA or from the KCB MPESA LOAN account.

LOANS APPS IN KENYA

Looking for Loans apps in Kenya? Lucky, you. Kenya has many options for you to access instant loan apps online, that offer immediately processed loans.

Though there are many options out there, here we will highlight the 10 most popular Loans Apps in Kenya that make it the process of borrowing and repayment as simple as possible.

Featured are mobile loan apps, p2p borrowing sites, as well as mobile-based solutions.

Keep in mind that these services mostly provide micro-loans. Although they are quick and unsecured, the downside is that they are often small, but with a good repayment history you gradually gain access to bigger loans.

The loans disbursed range from Sh.1,000 up to Sh.1,000,000. If you are looking for a business loan.

MSHWARI

First on the list is the most common, but often abused micro-borrowing platform. You automatically qualify for Mshwari Loan once you have been active on Mpesa for at least six months. The platform has been around since 2012 and it has certainly served many Kenyans well. The best part about Mshwari Loan is that the loans are instant, only limited by your loan limit.

The minimum loan amount is Sh.100 and you can gradually raise your Mshwari loan limit to Sh.20,000. Your loan limit is determined by Safaricom, based on your Mpesa transaction history and past loan repayments.

All mshwari loans have a repayment duration of 30 days at a flat 7.5% interest rate. If you default on an Mshwari loan, the repayment period is extended by an additional 30 days while an additional 7.5% facilitation fee is applied. Thereafter, you will lose access to Mshwari for 30 days for late loan repayment.

- Eligibility: Be a registered & active Mpesa user for over (6 months)

- Minimum loan amount: Sh. 50

- Maximum loan amount: Sh. 1,000,000

- Repayment duration: 30 days

- Loan Interest: 7.5%

KCB MPESA LOAN

KCB Mpesa Loan is one of the favourites, in fact, I prefer it to Mshwari. To qualify, you only need to have an active Mpesa account. You can find the KCB Mpesa menu under the loans and savings option in Mpesa. The service is facilitated by KCB bank, but it is separately managed from the usual KCB accounts. You can have a KCB Mpesa even if you are a current customer of the bank.

The minimum loan amount issued is usually Sh.100. However, as compared KCB often offers much better loan limits compared to Mshwari. Plus, it is much easier for your loan limit to increase, with the maximum amount issued pegged at Sh.1,000,000.

Their repayment structure is preferred since they charge 1.16% per month with a one off negotiation fee of 2.5%. The cost for the one month loan is 3.66% with excise duty applicable on fees.

Eligibility: Be a registered & active Mpesa user for over (6 months)

- Minimum loan amount: kshs 50

- Maximum loan amount: kshs. 1,000,000

- Repayment duration: 1 – 3 months.

Loan Interest: 1.16% per month with a one off negotiation fee of 2.5%. The cost for the one month loan is 3.66% with excise duty applicable on fees.

BRANCH LOAN

Branch are one of the best providers of micro MPESA-loans. Branch works exclusively through a mobile app, though their mobile apps seems to invade ones privacy as it works by accessing your Facebook account.

The other providers on this list require you to have an android phone to make it easy for the app to gain access to your Mpesa transaction messages. These are used to determine your eligibility and loan limit.

You will have to start by accessing the minimum loan amount offered at Sh.1000. Each successful repayment increases your loan limit while lowering your interest rate. Branch is one of the best mobile loan app providers and is highly recommended.

The repayments must be completed through 3 equal weekly installments.

- Access Branch loans by downloading the Branch App from the Play Store

- Eligibility: Be a Registered and active Mpesa user, Facebook account, and access of more SMS and Mpesa transaction messages on your phone.

- Minimum loan amount: kshs.1000

- Maximum loan amount: Sh.20,000

- Repayment duration: 3 equal weekly installments

SAIDA LOAN APP

Saida is a Mobile app, that is very similar to Branch and Tala, although it is difficult to qualify for their loans. To be eligible, you need to be very active on Mpesa/Airtel Money and make transactions every two days; make and receive calls/sms daily; proof of income that is enough to allow you to pay back the loan.

- To access Saida, download the app from the Fill in your mobile number and wait for an invitation to access loans.

- Minimum loan amt: shs.600

- Maximum loan amt: Sh.15,000

- Repayment duration: 30 days

- Loan interest rate: 10%

ZIDISHA

Zidisha is a p2p lending platform. Peer-to-peer lending, sometimes abbreviated P2P lending, is the practice of lending money to individuals or businesses through online services that match lenders directly with borrowers.

Zidisha is a non-profit organization that connects borrowers from Kenya and across Africa, with lenders from North America and Europe.

- Minimum loan amount: $100

- Maximum loan amount: $10,000

- Repayment duration: weekly or monthly installments

- Loan interest rate: None.

TALA INSTANT MOBILE LOANS

Tala was the the first instant mobile loans app launched in Kenya as Mkopo Rahisi in 2014. To access Tala loans , you need to have an android smartphone as well as an active Facebook account.

To start, simply download the Tala App from the Google PlayStore. Launch the app and link your Facebook account and you will be ready to start using the service.

Before borrowing a loan, you will be asked a few personal questions that will determine whether you qualify for a loan. However, the app mainly depends on reading your mpesa transaction history to determine whether you will be allowed access to Tala loans.

The minimum loan amount offered is Sh.500, while it can increase to Sh.50,000 on the back of a good repayment history. You are supposed to pay the loan back in 3 weekly installments while the interest rate is pegged at 15%.

- Minimum loan amt: ksh.500

- Maximum loan amt: kshs.50,000

- Repayment duration: 3 equal weekly installments

- Loan interest rate: 15%

KIVA

Kiva is a p2p borrowing platform that is quite similar to zidisha, although it does not work quite as well as Zidisha locally.

- Minimum loan amt: Dependent on lenders

- Maximum loan amt: Dependent on lenders

- Repayment duration: Not specified

- Loan interest rate: 34% (varies by country and partner)

- Loan disbursement mode: via PayPal/Kiva account

KOPA CHAPAA

Kopa Chapaa is Airtel’s Version of Mshwari although it has been around since 2012. While Mshwari loans are facilitated by CBA Bank, Kopa Chapaa is facilitated by Faulu Bank. To be eligible for the loan, you must have been an airtel money user for at least 6 months.

The minimum amount disbursed is Sh.500 while the maximum is Sh.100,000. However, the loan has a surprisingly short repayment duration of 10 days. I believe that this is a very major drawback since KCB Mpesa offers an option of paying back the loan in up to 3 months.

- Eligibility: Be an active Airtel Money User

- Minimum loan amt: kshs.500

- Maximum loan amt: kshs.10000

- Repayment duration: 10 days

PESA PATA

This service facilitated by Paddy Micro-investments is one of the lesser known, but still highly efficient provider of micro-loans in Kenya. Pesa pata has been around since 2012. To be eligible for the service, the only requirement is that you must be an active Mpesa user, along with an active Facebook account.

To use Pesa Pata, download the and install the App from the Playstore, and send in your loan application fro the App. However, you will be required to pay a Sh.100 processing fee before your loan is approved/declined.

The loan interest rate is one of the highest at 30% while you are expected to make weekly repayments via Mpesa.

PESA NA PESA (PNP)

Pesa na pesa goes last on the list because it requires physical registration with the company, but this is done only once. Also, you have to provide a form of collateral when borrowing larger loans.

- Minimum loan amt: kshs 500

- Maximum loan amt: kshs. 10,000

- Repayment duration: 10 days

- Loan interest rate: 10%

AIRTEL MFANISI

M-Fanisi the mobile based bank account that is available to only Airtel Money registered customers, bundles Loans, Savings and Fixed deposit options in the initial offer. ‘M-Fanisi’, is offered to Kenyans through Airtel who would like to have quick easy access to loans.

Airtel M-Fanisi offers:

- 7 to 30 days loans at 3% to 7.5% one-off facilitation fees respectively.

- Fixed deposit account for a period up to a maximum of 12 months and earn attractive interest of up to 11.25% p.a.

- Savings account and earn interest of 7% p.a.

- Money transfers in and out of the M-Fanisi to Airtel Money for FREE.

To apply for M-Fanisi using your Airtel Account follow the steps below:-

- Dial *222*3#and select M-Fanisi.

- Accept the product terms and conditions.

- Confirm your registration details.

- Then enter your Airtel Money PIN to activate.

Before taking a loan it is wise to read our 5 Questions to ask yourself before you take a Loan.

See: How to apply Fuliza Mpesa Loan

See how to apply for these top 10 Loan Apps in Kenya, KCB Mpesa Loan, Saida Loan, MShwari, Timiza Loan, Branch Loan, Okash loan, Tala Loan.

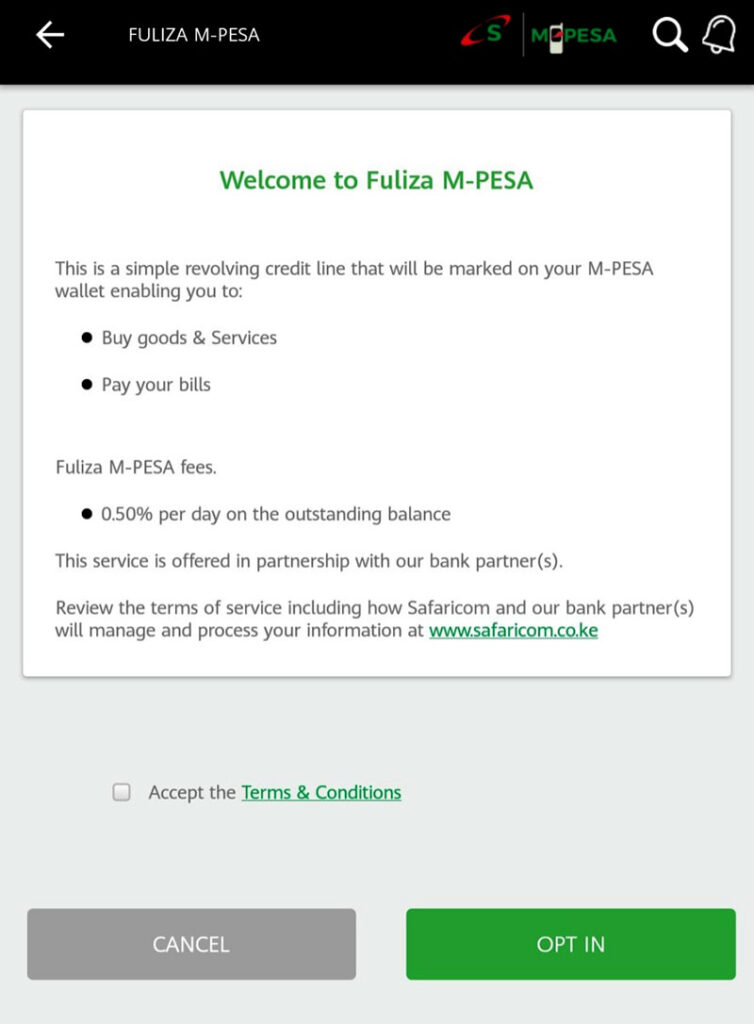

Fuliza Mpesa loan, rates, limit, app and how it works from Safaricom describes how the new overdraft service allows Safaricom Mpesa customers complete their Mpesa transactions when you have insufficient funds during payment.

Safaricom Fuliza overdraft facility was announced in late 2018 with it going live just a few days ago. In less than 1 week since its launch, Fuliza attracted more than 1 million users borrowing over 1 Billion Kenyan sillings according to Safaricom CEO Bob Collymore who spoke with Reuters.

Fuliza Mpesa Loan

Fuliza Mpesa loan is actually an overdraft service and not a loan as most of Kenyans think. This overdraft facility enables you to complete your MPESA transactions when you have insufficient funds. Within less than an a week Safaricom Mpesa customers have drawn more than KES 1.5 billion, which is quite impressive and scary at the same time.

How Fuliza Mpesa works

How Fuliza Mpesa works, is pretty straight forward.

Like a bank overdraft facility, when you are buying an item say at KES 4,000 and you only have KES 3,500 in your Mpesa account, depending on the Safaricom Fuliza Mpesa “loan” amount Safaricom has in place on your account (your overdraft facility), Fuliza will allow you to borrow the difference KES 500 for a maximum period of 30days.

When you make the payment of KES 4,000 with your Mpesa including the added Fuliza facility, your Mpesa balance will now show as KES – 500 (negative) since you are now overdrawn by KES 500.

It’s important to note: Once you take the Safaricom Fuliza Mpesa loan or rather overdraft facility you will first incur a 1% one off access fee, and an additional daily charge depending on the Fuliza Mpesa Rates as listed below until the day you fully pay your Fuliza overdraft.

If you borrow between.

KES 0 to 100 you will only pay a one-time fee of KES 2 and no daily charge.

Borrow between KES 101 to 500 and you pay KES 5 everyday till you pay off in full.

Borrow between KES 501 to 1,000 and you pay KES 10 everyday till you pay off in full.

Borrow between KES 1,001 to 1,500 and you pay KES 20 everyday till you pay off in full.

Borrow between KES 1,501 to 2,500 and you pay KES 25 everyday till you pay off in full.

Borrow between KES 2,501 to 70,000 and you pay KES 30 everyday till you pay off in full.

These are also the Fuliza Mpesa Rates Safaricom uses for the charges that they place on the Fuliza overdraft facility on offer.

Before taking the Safaricom Fuliza Mpesa “loan” – overdraft it is wise to read our 5 Questions to ask yourself before you take a Loan.

How to apply Fuliza loan

If you are looking on how to apply fuliza loan, you need to have a registered Mpesa account with an active Safaricom line.

To apply for Fuliza loan, dial *234# then select Fuliza Mpesa and opt in.

apply Fuliza loan – Dial *234# & opt in

That simple, every Mpesa registered line can be registered for a new Fuliza account, with its own Fuliza account limit. Fuliza limit is reviewed every 3 months depending on your Fuliza Mpesa usage.

You cannot withdraw funds from your Fuliza MPESA account.

Fuliza Mpesa Rates

Fuliza Mpesa Rates as shown below. 1% access fee and a maintenance fee will be charged on the outstanding balance as per the Fuliza rates table shown below. Additionally standard MPESA transaction charges also apply.

| Amount | Rates | Promotional Fuliza Mpesa Rates for 30 day from launch |

| 0 -100 | One-time fee of Ksh 2 | One-time fee of Ksh 0 |

| 101-500 | Ksh 5 per day | |

| 501-1000 | Ksh 10 per day | |

| 1001-1500 | Ksh 20 per day | |

| 1501-2500 | Ksh 25 per day | |

| 2501-70000 | Ksh 30 per day |

Fuliza Mpesa Rates

The current Fuliza Mpesa Rates shown here are promotional rates Safaricom is offering for the next 30 days. Check again as these Fuliza rates may change soon.

How to pay Fuliza Loan

Once you take the Fuliza loan, you really don’t have to worry so much about how to pay Fuliza Loan. Much of the repayment process happens automatically through your Mpesa account. When you receive funds or deposit cash to your Mpesa account, any outstanding Fuliza Mpesa balance will be automatically deducted from your Mpesa balance immediately funds hit your Mpesa after taking the Fuliza overdraft.

Fuliza Mpesa loan Penalties for late repayment

If you don’t pay your Fuliza Mpesa loan within the 30 days that you are given for your overdraft facility, Safaricom will stop access to your Fuliza Mpesa limit and you won’t be able to borrow until you fully repay your Fuliza balance in full.

Safaricom Fuliza Mpesa and M-Shwari are run by Safaricom in partnership with CBA. CBA also has a similar service called CBA Loop, through their Loop app.

Check out the Top 10 Loan Apps in Kenya, KCB Mpesa Loan, Saida Loan, MShwari, Timiza Loan, okolea Loan, Okash Loan, Tala Loan, Branch Loan.

Mkopo Rahisi, is a mobile-based loan service owned by InVenture Mobile Limited (Tala).

Using an app they instantly scores individuals and offers Mpesa loans to those who lack access to formal financial services.

One does not need to have a bank account to access a loan, but he or she must own a mobile phone with mobile money platform MPesa and a connection to social media sites, such as Facebook.

Mkopo Rahisi profiles prospective customers using their financial transactions, as well as the data on their social media accounts and web searches. From this, it works out the terms of loans and delivers the money instantly through Mpesa to their mobile phones.

Mkopo Rahisi pays a maximum of Sh10,000 at interest rates of between 5 and 15 per cent.

Founded in 2012, InVenture is based in New York and has offices in Santa Monica, New York and Nairobi. The app’s main competitor is M-Shwari, which is a partnership between Commercial Bank of Africa (CBA) and Safaricom.

Mkopo Rahisi loan app was launched in Kenya in March 2014, and has since expanded to Tanzania, with its eye on more African markets.

The app, available through Android’s Google store, was as a result of more than 3, 000 interviews of individual borrowers across countries in Africa over two-and-a-half years.

Currently, it has been downloaded over a million times. By end of 2015 it had more than 50,000 active customers and disbursed 120,000 loans to middle and low-income Kenyans.

“From the start of the loan application to the receipt of money can take as little as two minutes. Of our users, 88 per cent are done with the loan application in under 10 minutes,” said Mkopo Rahisi Kenya Business Director Ronald Maira.

He added that the idea of short-term loans requiring no collateral has been a key selling point for them, which has seen the app register a client return rate of 92 per cent.

The credit company depends on social media platforms and testimonials from previous beneficiaries to grow its customer base. Some of the key components that Mkopo’s risk analysis encompasses are M-Pesa transaction history, social network activity, education, employment, browsing history, spending patterns and previous loan history.

The company plans to increase its credit limit to Sh100,000 in the future, especially for customers with a strong repayment history. Of the loans disbursed so far, 55 per cent have been for purposes of business, and 19 per cent for travel expenses.

A further 14 per cent have been taken by customers who wanted to attend to emergencies. Among those who took out loans for business, 42 per cent used the money to boost their stock, while 23 per cent used it to start a business. Vincent Mbogori runs an electronics shop in Nairobi, and said he has so far taken 43 loans at an average Sh6,000 each time to boost his business. “I have established a good relationship with Mkopo Rahisi since last year, and now I borrow up to Sh7,000, sometimes at an interest rate of 10 per cent,” he said, adding that he hopes to see the credit limit increased to at least Sh20,000. The app determines interest rates based on a customer’s credit score.

Top on the list of worries of any financial lender is borrowers who default on their loans, a concern Mkopo Rahisi shares. The app relies on information from InVenture — which currently operates in Eastern Africa, South Africa and India — that is collected from an applicant’s mobile phone for a real-time credit score. With this, defaults have remained below 12 per cent, Mr Maira said.

“With the user’s permission, InVenture collects data from the applicant’s mobile device to verify identity, build financial, behavioural, and social characteristics for our proprietary algorithm, and to customise the loan terms to his or her unique circumstances,” he added.

Financial muscle: The capital required to get Mkopo Rahisi off the ground was injected by InVenture and other institutional capital providers. Since then, the app has built its financial muscle through Google Ventures, Lowercase Capital, Data Collective and Collaborative Fund.

Having tested the Tanzanian market, Mkopo hopes to get into more African markets in the next three to six months, and plans to hire a regional director to oversee East African markets. It will also soon migrate from a web app to a native app to increase its service speed and optimise it for low-speed data connections in Kenya. “We hope that through this, we will be able to provide all Kenyans with fair and flexible financial products,” said Maira.

Before taking a loan it is wise to read our 5 Questions to ask yourself before you take a Loan.

See: How to apply Fuliza Mpesa Loan

Check out these Top 10 Loan Apps in Kenya, KCB Mpesa Loan, Saida Loan, MShwari, Timiza Loan, Branch Loan, Okash loan, Tala Loan.

Get instant Timiza loans on your phone, pay bills, transfer funds and purchase insurance with Timiza.

Timiza Features

- Get instant Timiza loans on your phone

- Deposit funds into your Timiza Account

- Pay for KPLC/ZUKU/DSTV/GOTV bills with your loan

- Purchase insurance

- Buy airtime

How to Apply for Timiza Loans: Simply Dial *848# or download it from Google PlayStore.

Barclays TIMIZA Loans

- What are the requirements for a customer to have a Timiza Account?

- Be a registered Safaricom

- Be a registered Safaricom MPESA

- Have an active Safaricom MPESA account/line.

- Hold a Kenyan National Identification Document (ID) Kindly note that Kenyan passports are not

- What are the services that Timiza offers?

- Transfer from MPesa to Timiza

- Transfer from Timiza to M-Pesa

- Make a loan request

- Repay loan

- Balance enquiry

- Mini statement

- Bill Payments

- Insurance

- Airtime Purchase

- Book a Cab – Little Cab (App only)

- Invite Contacts (App only)

- Fx Rates (App only)

- Can I access Timiza through a Barclays Branch or through any electronic channel?

- Timiza is operated entirely from the mobile phone and cannot be accessed

through a Barclay’s branch. Timiza is a separate bank account and is NOT linked to your Barclays account or any other bank account.

Timiza Tariffs and Guides

- What are the interest rates applicable on the Timiza Deposit Account?

- In line with the Banking (Amendment) Act 2016, all deposits on the loan will earn interest of 7.00% p.a being 70% of CBR. The deposit account will be available

- What are the transactional charges for a deposit account?

| Transaction Fees | |

| Cash Deposit (C2B)** | |

| Via M-PESA | Mpesa Charges apply |

| Funds Withdrawal** |

| Transfer to M-PESA (B2C) ;tiered | |

| KES 0 – KES1000 | KES 23 |

| >KES 1000 | KES 30 |

| Transfer between loan Accounts | Free |

| Other Services** | |

| Bill payment BBK Charges | KES 50 ( As per existingapproved tariff) |

| USSD Costs charged by Safaricom | KES 2 |

**all fees are subject to a 10% government excise duty

- What are the transactional charges for the loan product?

| Timiza Loan Costs | |

| Interest Rate | CBR + 4% (1.17%) |

| Loan processing fees | 5% per successful loan application |

| Roll Over Fees | 5% of the outstanding loan amount |

Timiza Loan Product

- What are the features of the Loan?

- Quick access to credit

- Loan repayment period is 30 days

- One time facility fee of 5%

- Rollover fee of 5% if the customer does not pay within the 30 day

- Loan is disbursed to the customers account (not directly to Mpesa). Customer will access the funds by withdrawing from their loan account to Mpesa

- Who is eligible for the loan?

- In order to qualify for a loan all you need is to be an M-PESA subscriber for 6 months, transact on the app and actively use other Safaricom services such as voice, data and M-PESA.

- How do I check how much I can borrow?

- Upon activating the account, you will be issued with a loan limit from where you can borrow

- Is there any interest charged on my loan?

- Loans attract an interest charge of 1.17% with a facility fee of 5% charged on the cost of processing the

- Can you request for a loan immediately you opt-in?

- Yes your loan limit will be displayed when you log in to the app

- Can you have more than one loan at a time?

- You have to repay your outstanding loan first before you can borrow another loan.

- Can you pay a loan on behalf of another person?

- You can send money to their loan account and they can pay the

- If you have not paid your loan within 30 days, what will happen?

- Your loan repayment period will be extended for an additional 30 days and you will be charged an additional 5% facilitation fee on your outstanding loan

- What happens if you pay in excess of the loan amount?

- The outstanding loan balance will be paid off and the extra amount will be moved to your Timiza

- If you pay your loan before the due date, will you still be charged the loan facilitation fee of 5% on the loan amount?

- Yes, the 5% is a facilitation fee charged on the cost of processing the loan. Early repayment will increase your future loan limit

- I cannot access my loan. What are some of the reasons for this?

- You have been listed with the Credit Reference

- You already have an existing account

- You have a low credit

- How do I grow my loan limit?

- Increase activity on your Barclays Loan Account by moving money in and out of your

- Increase savings on your Barclays Loan

- Increase usage of MPESA

Timiza Insurance

- What insurance products are available on your loan account

- We offer Personal Accident(100K) and Funeral Cover

- What are the features of the insurance products

- The insurance products offered cover death and permanent total disability

- What are the charges?

- Your policy will be covered at Kes 42 per month

- How do I apply?

- Log in to to loan account by dialling *848#

- Pick the insurance option

- Accept the terms and Conditions

- Subscribe to the insurance option

- How do I make premium payments?

- The premium payments will be deducted from the deposit in your Timiza It is important to ensure that there are funds in the account to cater for the premium.

- Can I make the premium payment from a my loan account? YES, If Premium amount is deposited in the virtual account

- What are the charges?

- There are no additional charges to the insurance payment other than the Premium payment

Before taking a loan it is wise to read our 5 Questions to ask yourself before you take a Loan.

Check out these Top 10 Loan Apps in Kenya, KCB Mpesa Loan, Saida Loan, MShwari, Timiza Loan, Branch Loan, Okash loan, Tala Loan.

See: How to apply Fuliza Mpesa Loan

Fintech companies offering loans has led to an increase in greedy lending practices in Kenya, Central bank governor said on Tuesday, calling for the sector to be regulated.

Kenya as a pioneer of financial inclusion through its early adoption of a mobile money system that enables people to transfer cash and make payments on mobile phones without a bank account.

A huge rise of Fintech companies (financial technology companies) are using the same technology to extend credit to the banked and unbanked alike, burdening Kenyan lenders with high interest rates at the same time leaving regulators struggling to keep up.

From having little or no access to credit, many Kenyans even the ones who can’t afford these loans are now finding they can get loans in minutes through these Fintech companies.

“There’s an increase in let’s say Fintech companies that are taking advantage of our population,” Patrick Njoroge told executives in the digital financial services industry at a conference in Nairobi.

“In a sense what has happened is there is an opportunity by some predators and they are preying on our population.”

Since 2015, 2.7 million people in Kenya out of a population of around 45 million have been negatively listed on Kenya’s Credit Reference Bureau, according to a study by Microsave, a consultancy that advises lenders on sustainable financial services.

Kenya is thought to be a test case for the new mobile cash lending platforms. A number of companies involved, including U.S. fintech companies, have plans to expand in other cutting edge markets, meaning Kenya’s regulation will be closely watched.

Patrick Njoroge said he did not like the idea of his country being a “guinea pig” for new technology deployed by foreign fintech companies.

“What I think is worrisome is a lot of products that are coming in a sort of a fly-by-night operation and you only hear about it because somebody gets burned,” he said.

He said the risks to Kenyans showed there was a need for regulation in the booming mobile money lending sector.

A draft bill published by the finance ministry last week for review and comment by the public and industry says digital lenders will be licensed by a new Financial Markets Conduct Authority and lenders will be bound by any interest rate caps the Authority sets.

But it is not clear if fintech companies are subject to the current government cap on banks’ interest rates which has slowed private sector credit growth since it was introduced in 2016.

What is a credit score?

This is a question many would like to understand. Credit Score are the factors that are considered when credit bureaus calculate your credit record.

Credit records are used by credit providers to determine the amount of credit to offer a consumer, and on what terms.

A consumer’s credit score is calculated by a credit bureau based on a person’s credit report. The bureau considers how a consumer pays their bills, how much debt they have and how all of that relates to other credit active consumers.

The Credit Bureau

Each bureau has a different way of calculating the credit score. They take into account different forms of information, including information their organisation already has on you, or your employment circumstances.

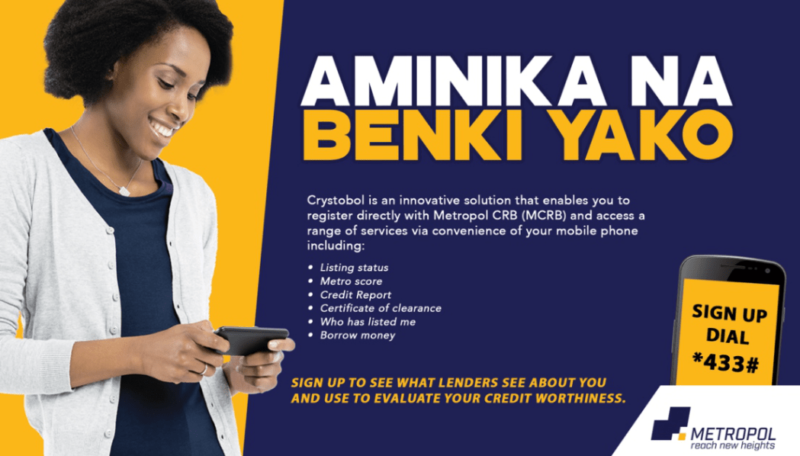

Major credit bureaus like Metropol Corporation and Creditinfo Credit Reference Bureau Kenya Limited provide a service that can check your credit report; consumers are advised to check their reports and immediately query any possible errors.

Factors affecting your score

One factor that may affect your score is the number of searches companies and banks have made because of multiple applications for loans or store cards.

This shows that you have been trying everyone and everywhere to get credit, but you were not successful. If you were successful there would only have been one or two searches. This increases your risk and reduces your credit score.

Another factor affecting consumer’s credit score is how long they have been in the same job and at the same address. Credit providers are looking for stability in consumer behavior.

The record also shows on which accounts payments were made late, and for how long accounts have been in arrears. The consumer’s credit record also reflects default court rulings.

Most important component

The single most important component of the credit score is the payment history, which makes up about 35% of the total score. Late payments will reduce one’s score.

A high score means the consumer has a healthy credit record. It will make it easier to borrow money at a lower interest rate.

We hope this has been informative and know you have a better understanding on what is a credit score.