Tala formerly Mkopo Rahisi is used by most Kenyans taking out its Tala app loan to help them keep their business running.

For most business owners in Kenya, their customers buy their products on credit forcing them to borrow so that they can go to the market and buy goods for sale as they wait for payment. Accessing these numerous mobile loans to start a business has become a quick solutions for most entrepreneurs.

Mobile loan companies such as Tala formerly Mkopo Rahisi are expanding their business in Kenya, using it as a testing ground for the financial industry. Kenya has faced criticism recently, driven by fears that without effective regulation, these efforts to spread loans to borrowers could damage the achievements of mobile payments.

Effects of the Tala app loan

A study conducted by Tala formerly Mkopo Rahisi, highlights the effects these Tala app loan have and why access to the loans alone is not enough. The study pulled data from 795 randomly selected Tala customers, most of whom are educated, between the age of 25 to 34 years, and earning $2 to $19 a day. The Tala loans supports customers deal with unforeseen emergencies, enable them finance their small businesses, and also helps reduce the borrower’s stress levels.

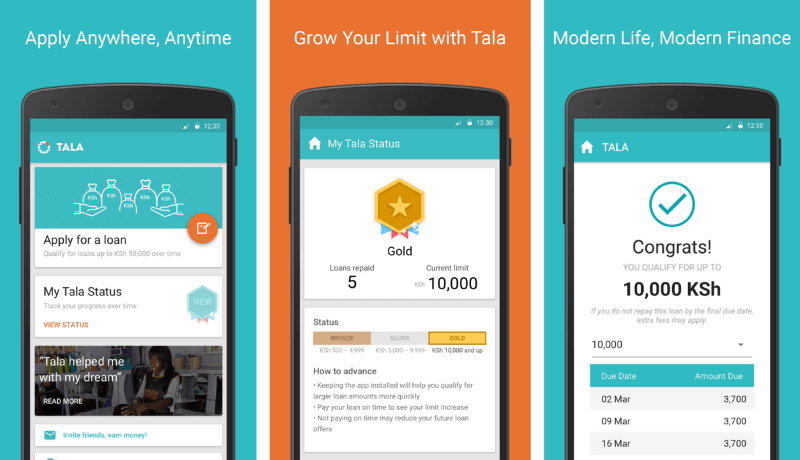

15% of Tala customers say they use Tala app loan to start a business, a side hustle as Tala formerly Mkopo Rahisi calls it. 70% of business people who use Tala loans, use it to cushion irregular income and expenses. Only 15% used the Tala loan primarily for business expansion, possibly because these loans are short-term loans that usually range from 2,000 to 10,000 Kenyan shillings. Tala is at present working to offer higher value loans.

According to Tala, some Kenyans do repeat borrowing even when they don’t need the loan just to build their credit limit, which will allow them secure a bigger loan amount when they need it. Tala loan app has membership categories (bronze, silver, and gold) that set the allowed loan amount a member can borrow. Gold category allows the member to borrow between 10,000 to 50,000 Kenyan shillings.

It is also important to note Tala formerly Mkopo Rahisi shares their credit history file both positive and negative performance on their Tala app loan to credit reference bureau in Kenya. About 95% of Tala customers do not know this.

Understand the terms of your loans

Kenyans new to mobile loans must get support from loan suppliers like Tala formerly Mkopo Rahisi to understand the terms of these loans, their advantages and consequences. The financial industry in Kenya must consider how to address financial literacy in addition to loan delivery.

Some of the improvements Tala has brought to the table for their Tala app loan is the new reminders, like the importance of paying bills on time, or the risk of taking on too much debt before the holidays, then testing which messages appear to work well with their customer base. Tala has also launched a Q&A discussion they call “Q&A Friday” on their Facebook page so that they can reply to customer questions on social media.

Most of Tala customers in Kenya have fairly high access to loans, with about 2 percent of Tala customers in Kenya using “shylocks,” or loan sharks, who can be exploitative. There are also fears about risks including over borrowing since mobile loans have become too easy to access and common.

In 2013 Tala formerly Mkopo Rahisi launched their Tala app loan in Kenya. It was one of the few if not the only mobile loan company in service. Kenya was also their first market, today they are in Kenya, Tanzania, Mexico, and the Philippines, with a pilot in India. Tala also has an investment from PayPal, working on its $65 million Series C funding round, which will assist the company grow its worldwide reach.

Before taking a loan it is wise to read our 5 Questions to ask yourself before you take a Loan.

Check out these Top 10 Loan Apps in Kenya, KCB Mpesa Loan, Saida Loan, MShwari, Timiza Loan, Branch Loan, okolea loa, Okash loan, Tala Loan.