What is a credit score?

This is a question many would like to understand. Credit Score are the factors that are considered when credit bureaus calculate your credit record.

Credit records are used by credit providers to determine the amount of credit to offer a consumer, and on what terms.

A consumer’s credit score is calculated by a credit bureau based on a person’s credit report. The bureau considers how a consumer pays their bills, how much debt they have and how all of that relates to other credit active consumers.

The Credit Bureau

Each bureau has a different way of calculating the credit score. They take into account different forms of information, including information their organisation already has on you, or your employment circumstances.

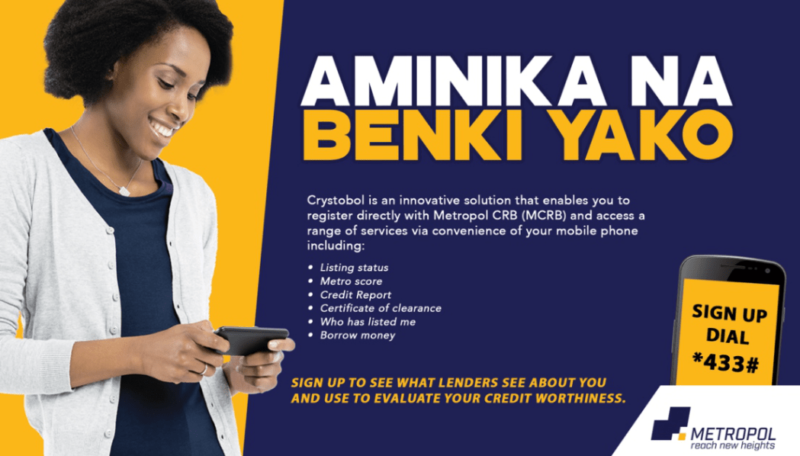

Major credit bureaus like Metropol Corporation and Creditinfo Credit Reference Bureau Kenya Limited provide a service that can check your credit report; consumers are advised to check their reports and immediately query any possible errors.

Factors affecting your score

One factor that may affect your score is the number of searches companies and banks have made because of multiple applications for loans or store cards.

This shows that you have been trying everyone and everywhere to get credit, but you were not successful. If you were successful there would only have been one or two searches. This increases your risk and reduces your credit score.

Another factor affecting consumer’s credit score is how long they have been in the same job and at the same address. Credit providers are looking for stability in consumer behavior.

The record also shows on which accounts payments were made late, and for how long accounts have been in arrears. The consumer’s credit record also reflects default court rulings.

Most important component

The single most important component of the credit score is the payment history, which makes up about 35% of the total score. Late payments will reduce one’s score.

A high score means the consumer has a healthy credit record. It will make it easier to borrow money at a lower interest rate.

We hope this has been informative and know you have a better understanding on what is a credit score.